by Amy Fontinelle @ investopedia.com

Debit card fraud occurs when a criminal gains access to your debit card number and, in some cases, PIN, to make unauthorized purchases and/or withdraw cash from your account. There are many different methods of obtaining your information, from unscrupulous employees to hackers gaining access to your data from a retailer’s unsecure computer.

When your debit card is used fraudulently, the money is missing from your account instantly. Payments you’ve scheduled or checks you’ve mailed may bounce; you may not be able to afford necessities, and it can take awhile for the fraud to be cleared up and the money restored to your account.

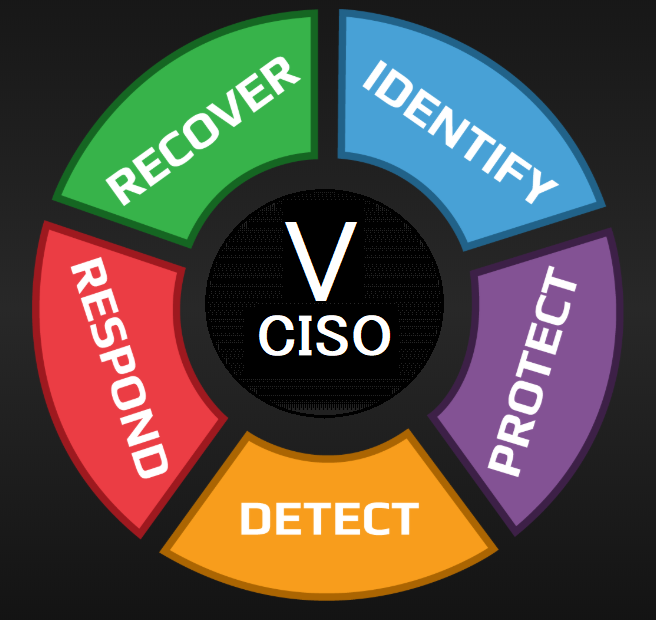

How to Detect Debit Card Fraud

Fortunately, it doesn’t take any special skills to detect debit card fraud. The easiest way to spot problems early is to sign up for online banking, if you haven’t already. Check your balance and recent transactions daily. The sooner you detect fraud, the easier it will be to limit its impact on your finances and your life. If you see unfamiliar transactions, call the bank right away. If you’re the forgetful type, start hanging on to the receipts from your debit card transactions so you can compare these against your online transactions.

If you don’t want to bank online, you can keep tabs on your recent transactions via phone banking. In the very least, you should review your monthly bank statement as soon as you receive them, and check your account balance whenever you visit an ATM or bank teller. However, it can take much longer to detect fraud using these methods.

9 Easy Ways to Protect Yourself

While you may not have any control over hackers and other thieves, there are many things you can control that will help you avoid becoming a victim.

• Get banking alerts. In addition to checking your balance and recent transactions online daily, you can sign up for banking alerts. Your bank will then contact you by email or text message when certain activity occurs on your account, such as a withdrawal exceeding an amount you specify or a change of address.

• Go paperless. Signing up for paperless bank statements will eliminate the possibility of having bank account information stolen from your mailbox. Shredding existing bank statements and debit card receipts using a diamond-cut shredder when you’re done with them will greatly reduce the possibility of having bank account information stolen from your trash.

• Don’t make purchases with your debit card. Use a credit card instead, because it offers greater protection against fraud. If you do make debit card purchases, don’t use your PIN – tell the cashier to select the credit option. The money for your purchase will still be withdrawn from your account right away, but you won’t expose yourself to PIN theft.

• Stick to bank ATMs. They tend to have better security (video cameras) than ATMs at convenience stores, restaurants and other places.

• Destroy old debit cards. Some shredders will take care of this for you.

• Don’t keep all your money in one place. If your checking account is compromised, you want to be able to access cash from another source to pay for necessities and meet your financial obligations.

• Beware of phishing scams. When checking your email or doing business online, make sure you know who you’re interacting with.

• Protect your computer. Use firewall, anti-virus and anti-spyware software on your computer, and keep it updated regularly.

• Use a secured network. Don’t do financial transactions online, when using your computer in a public place and/or over an unsecured network.

What to Do If It Happens to You

If you learn that your debit card information has been compromised, contact your bank immediately to limit the damage the thief can do, and limit your financial responsibility for the fraud. Make contact immediately by phone, and follow up with a detailed letter stating the full name of the bank employee you spoke with, details of the fraudulent transactions, and any ideas you have about how your account may have been compromised. Ask your bank to waive any NSF fees that may be incurred because of the fraud, and to restore the fraudulently withdrawn funds to your account.

Hopefully, you won’t have any trouble resolving the issue directly with your bank, but if you do, you can contact a legitimate consumer advocacy group such as Privacy Rights Clearinghouse. There are also government organizations to contact if your bank isn’t cooperating. The agency to contact depends on the type of bank you use.

• The Federal Reserve Board of Governors handles complaints for state-chartered Federal Reserve System banks, bank holding companies and branches of foreign banks.

• The FDIC deals with state-chartered, non-FRS banks.

• The National Credit Union Association handles federally chartered credit unions.

• The Office of the Comptroller of the Currency (OCC) oversees national banks.

• The Office of Thrift Supervision keeps an eye on federal savings and loans and federal savings banks.

• The Federal Trade Commission handles everything else.

If you’re not sure which one to call, start with the OCC.

If you will have trouble making any of your monthly payments because of the fraud, contact those creditors, explain the situation and ask if they can do anything for you. This step is extremely important, as failure to do so implies your unwillingness to pay them. However, if they know about your hardship, they may be willing to work with you to reschedule payments.

Conclusion

Anything you can do to make a thief’s work more difficult, whether it’s staying on top of your balance, spreading your cash out across multiple accounts or making purchases with credit cards instead of debit, will help safeguard your checking account and decrease your chances of becoming a victim of debit card fraud

Tags: ATM, debit card, debit card fraud, Federal Trade Commission, OCC, PIN theft