The cybersecurity insurance sector is experiencing swift expansion, with its value surging from around $13 billion in 2022 to a projected $84 billion by 2030, reflecting a robust 26% compound annual growth rate (CAGR). However, insurance providers are encountering challenges when it comes to accurately assessing the potential hazards associated with providing coverage for this category of risk.

Conventional actuarial models are ill-suited for an arena where exceptionally driven, innovative, and astute attackers are actively engaged in orchestrating events that lead to insurable incidents. Precisely gauging potential losses holds utmost importance in establishing customer premiums. However, despite a span of twenty years, there exists a substantial variance in loss ratios across insurance providers, ranging from a deficit of 0.5% to a surplus of 130.6%. The underwriting procedures lack the necessary robustness to effectively appraise these losses and set premiums that reflect a reasonable pricing.

Why is the insurance industry struggling with this?

The problem is with the nature of the threat. Cyber attackers escalate and adapt quickly, which undermines the historical-based models that insurance companies rely on. Attackers are continually shifting their maneuvers that identify victims, cause increasing loss, and rapidly shift to new areas of impact.

Denial of service attacks were once popular but were superseded by data breaches, which cause much more damage. Recently, attackers expanded their repertoire to include ransomware-style attacks that increased the insurable losses ever higher.

Trying to predict the cornerstone metrics for actuary modelers – the Annual Loss Expectancy and Annual Rate of Occurrence – with a high degree of accuracy is beyond the current capabilities of insurers. The industry currently conducts assessments for new clients to understand their cybersecurity posture to determine if they are insurable, what should be included/excluded from policies, and to calculate premiums. The current process is to weigh controls against best practices or peers to estimate the security posture of a policyholder.

However, these rudimentary practices are not delivering the necessary level of predictive accuracy.

The loss ratio for insurance firms has been volatile, in a world where getting the analysis wrong can be catastrophic. Variances and unpredictability make insurers nervous. At maximum, they want a 70% loss ratio to cover their payouts and expenses and, according to the National Association of Insurance Commissioners Report on the Cyber Insurance Market in 2021, nearly half of the top 20 insurers, representing 83% of the market, failed to achieve the desired loss ratio.

In response to failures to predict claims, insurers have been raising premiums to cover the risk gap. In Q4 2021 the renewals for premiums were up a staggering 34%. In Q4 2022 premiums continued to rise an additional 15%.

There are concerns that many customers will be priced out of the market and the insurance industry and left without a means of transferring risk. To the detriment of insurers, the companies may make their products so expensive that they undermine the tremendous market-growth opportunity. Additionally, upper limits for insurability and various exception clauses are being instituted, which diminish the overall value proposition for customers.

The next generation of cyber insurance

What is needed are better tools to predict cyber attacks and estimate losses. The current army of insurance actuaries has not delivered, but there is hope. It comes from the cyber risk community that looks to manage these ambiguous and chaotic risks by avoiding and minimizing losses.

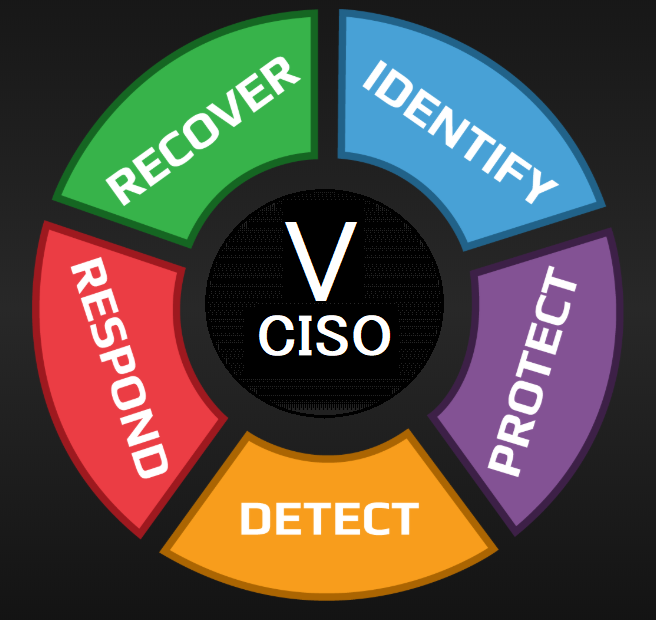

These cybersecurity experts are motivated by optimizing limited resources to prevent or quickly undermine attacks. As part of that continuous exercise, there are opportunities to apply best practices to the insurance model to identify the most relevant aspects that include defensive postures (technology, behaviors, and processes) and understanding the relevant threat actors (targets, capabilities, and methods) to determine the residual risks.

The goal would be to develop a unified standard for qualifying for cyber insurance that would adapt to the rapid changes in the cyber landscape. More accurate methodologies will improve assessments to reduce insurers’ ambiguity so they may competitively price their offerings.

In the future, such calculations will be continuous and showcase how a company will benefit by properly managing security in alignment with shifting threats. This should bring down overall premium costs.

The next generation of cyber insurance will rise on the foundations of new risk analysis methodologies to be more accurate and sustain the mutual benefits offered by the insurance industry.

The Cyber Insurance Imperative, 2nd Edition: Updated for Today’s Challenging Risk Landscape

InfoSec tools | InfoSec services | InfoSec books | Follow our blog | DISC llc is listed on The vCISO Directory