A recent report reveals that the number of attacks on financial service APIs and web applications worldwide increased by 257%.

There are more APIs in use than ever, and the average FinTech company takes advantage of hundreds if not thousands of connections in their daily operations.

APIs have become a critical component of fintech but also open new vulnerabilities. 48% of financial service company states that API security remains the top concern of their API utilization.

So, what are the top FinTech API security challenges?

Impacts Of API Attacks on Fintech

API attacks on fintech companies can severely affect the financial industry and the customers who rely on these services. These attacks are becoming increasingly frequent as fintech companies grow in popularity and usage.

API attacks can have serious consequences, including financial loss and damage to a company’s reputation. These attacks can steal sensitive information like login credentials or financial data. This data can be used for identity theft, financial fraud, and other criminal activities, causing significant financial losses for the affected customers.

They can also be used to disrupt services or conduct fraudulent transactions. Additionally, service disruptions can lead to lost business, damage to reputation, and loss of customer trust.

API attacks can also have a ripple effect throughout the financial industry. If a major fintech company is compromised, it can cause mistrust and uncertainty among other financial institutions. This can lead to increased scrutiny and regulations for the entire industry.

Fintech companies must take proactive measures to secure their APIs and protect their customers’ data. This includes implementing robust authentication and authorization mechanisms, encryption for sensitive data, and regularly testing and updating security measures.

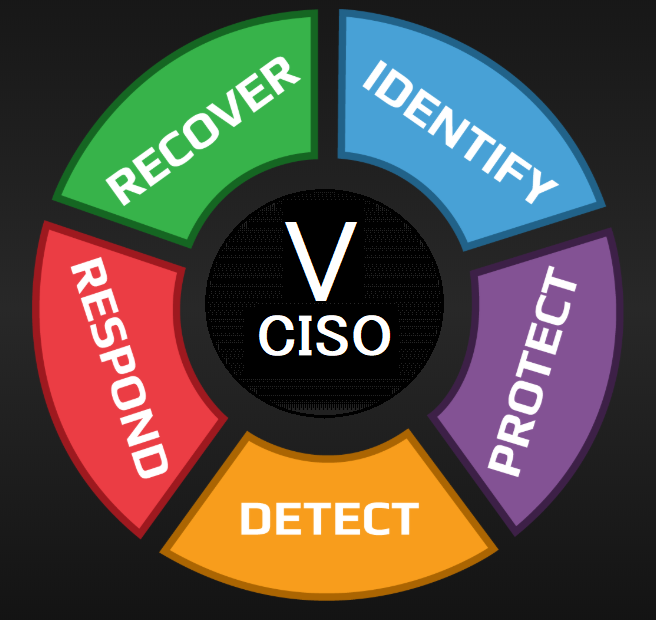

Additionally, having an incident response plan to address and mitigate potential breaches quickly is crucial in preserving customer trust and minimizing damage to the company’s reputation.

OWASP Top 10 API Security Risks

OWASP API Top 10 isn’t necessarily FinTech-specific. But with API usage exploding in every industry, it’s worth taking some time to understand the risks they’ve identified. After all, many modern companies would not exist without APIs.

- Broken object-level authorization

- Broken user authentication

- Excessive data exposure

- Lack of resources to rate limiting

- Broken function-level authorization

- Mass assignment

- Security misconfiguration

- Injection

- Improper assets management

- Insufficient logging and monitoring

What are the Challenges of Protecting APIs?

Explosive increase in API utilization

There has been a significant increase in the use of APIs in fintech in recent years. APIs allow fintech companies to easily integrate with other systems and services, such as banking platforms, payment processors, and data providers. This enables fintech companies to build new products and services quickly and easily and offer their customers a more comprehensive range of features.

As many APIs are integrated into third-party systems, it can be challenging to monitor for potential vulnerabilities.

Connections Create New Vulnerabilities & Risks

Most applications are made up of multiple services connected through APIs. This interconnectivity can inadvertently create new risks and vulnerabilities.

As interconnected services increase, the complexity of securing API connections also increases. Each connection represents a potential vulnerability that malicious actors could exploit. Additionally, as more services are connected, the attack surface for potential vulnerabilities also increases.

Data Exposure

FinTech companies handle sensitive financial information, making them prime targets for cyber attacks.

Tracking and monitoring for potential security threats can make it more difficult as more data is exposed through APIs. It can be difficult to track exactly,

- What needs to be protected and how?

- Where are APIs exposing data?

- Is the exposure necessary?

The larger the amount of data and the more diverse the sources, the harder it can be to identify and respond to security incidents.

Furthermore, the increased use of cloud and third-party services can complicate tracking, as it can be challenging to determine where data is being stored and how it is being used.

Data exposure can also be a moving target based on API updates. For maximum security, you must always remain mindful of changes.

Rapid Development

An API in FinTech is perfect for rapid innovation and development. New updates, features, and functionality can be rolled out quickly and smoothly.

APIs are constantly changing. And because of that, app developers need to roll out multiple updates yearly.

This creates a challenge for the security team because they need to be able to keep pace with changes and know what security structures need to include.

Developers Can’t Catch Everything

It’s difficult, if not impossible, to catch all possible vulnerabilities before deployment. Despite the care taken during the development process, it’s unrealistic to think that developers would be aware of everything that could go wrong.

Developers also need to move quickly. Because there are always new features to add and innovations to make, security can be an afterthought for better or worse.

Traditional Security Isn’t Enough

Most FinTech companies have sophisticated runtime security stacks already. These feature multiple layers of security tools. But these solutions simply aren’t enough when it comes to API vulnerabilities.

Traditional approaches to FinTech API security, such as basic authentication, do not provide adequate protection. Because they rely on static, easily compromised credentials and do not consider the dynamic nature of API usage.

Traditional approaches often rely on static rules and signatures, which can be easily bypassed by attackers who know how to evade them.

Additionally, these approaches do not provide visibility into API activity, making detecting and responding to threats difficult.

For API security, it is necessary to use more modern security techniques specifically designed for this purpose.

Lack of skills

Appdome says lack of skills was one of the top two challenges in an organization’s API strategy. Many organizations do not specialize in app security. And there are many factors to consider: development framework, OS, security features, and more.

API security should be a top priority for fintech. They could be turbulent if you don’t know how to navigate the waters ahead. Your best bet is to find a partner to assist you in setting up the necessary security infrastructures. The peace of mind with it will be well worth the investment.

API Protection with AppTrana

AppTrana API protection is a comprehensive security solution that provides advanced protection for your APIs.

One of its key features is API discovery, which allows you to automatically identify all the APIs within your organization and track their usage. This helps you to understand how your APIs are being used and identify any potential security risks.

Another important feature of AppTrana is its positive security model, which allows only known and trusted traffic to access your APIs.

AppTrana also includes rate limiting, a technique used to control the number of requests that can be made to an API within a certain period. This helps prevent malicious actors from overwhelming your APIs with many requests, which can cause them to become unresponsive or crash.

In addition to these features, AppTrana provides real-time monitoring and reporting, so you can quickly identify and respond to any security incidents. This includes detailed logs of all API activity and alerts for suspicious activity, such as excessive rate limiting or bot fingerprinting.

Checkout our previous posts on API Security

InfoSec books | InfoSec tools | InfoSec services